Nano: the hardest and only known fixed supply commodity in existence

A discussion on scarcity, monetary hardness, and the commonly conflated concepts of consensus, leader selection, and supply creation (issuance)

What does scarcity mean in the context of monetary assets?

How does scarcity compare to rarity or hardness?

Let's take a look at and compare the definitions.

What is scarcity?

"The gap between limited resources and theoretically limitless wants" - Investopedia

Scarcity is a sub-property of value, created explicitly by the states of supply and demand for a resource.

More specifically, it is the state in which there is insufficient supply to meet the total demand for the resource.

Technically, high divisibility makes most cryptocurrencies ample, not scarce.

Another important clarification is that there is no requirement of cost or effort in the creation of the existing supply of a resource for it to become valuable or scarce.

“Even abundant common resources long consumed at zero apparent cost often prove neither free nor limitless eventually.” - Investopedia

Even 100% free natural resources can accrue value and scarcity with time.

A classic example of this is water. To a community living near a body of water, it is effectively a free resource. But to a community living in a desert climate, it becomes an extremely scarce and valuable resource, especially with growth in community population and demand.

What is rarity?

Rare, on the other hand, is defined as "cooked for only a short time so that the inside is still red."

I kid, though rare to medium-rare is the only acceptable way to eat a steak. I will die on this hill.

The actual economic definition of rarity is…

"Existing only in small numbers and therefore valuable or interesting." - Oxford

This means that, to be considered rare, the quantity or supply of the resource must be relatively low.

Demand for the resource has no impact on its rarity.

Technically, large circulating supplies and high divisibility make most cryptocurrencies abundant, not rare.

What is monetary hardness?

Lastly, the economic definition of monetary hardness depends on the context.

“Traditionally, hard money referred to a currency made up of or directly backed by a valuable commodity such as gold or silver, and thought to maintain a stable value relative to goods and services and a strong exchange rate with softer monies.” - Investopedia

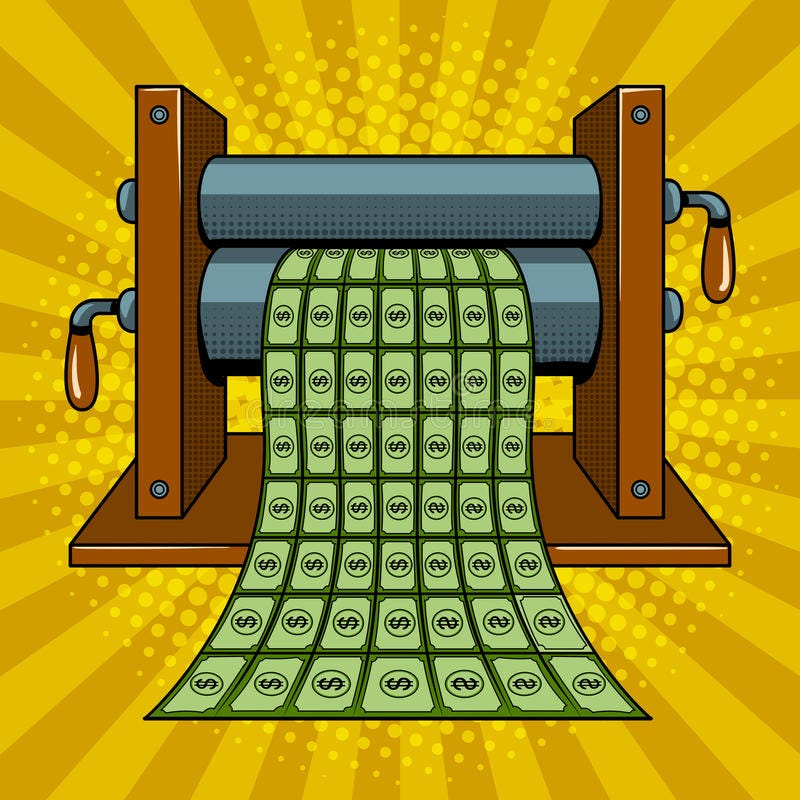

The relative difficulty of producing new monetary units determines the hardness of money: money whose supply is hard to increase is known as hard money, while easy money is money whose supply is amenable to large increases.” - Saifedean Ammous, The Bitcoin Standard

With regards to cryptocurrencies, hard money has become more of a measurement of predictability and quantity of new supply creation over time moving forward and the resulting debasement or deflation of unit value.

Therefore hardness is a quantifiable metric, measured by the protocol's specification for the rate and quantity of the creation of new supply over time moving forward.

Technically, restricted issuance makes most cryptocurrencies much harder than arbitrarily and infinitely inflationary fiat currencies.

Being that hardness is a measurement for creation of supply over time moving forward, hardness is therefore also a factor for speculation on scarcity.

So in the context of cryptocurrencies, what creates monetary hardness?

Advocates for proof of work (PoW) systems argue that it's the energy consumption that gives PoW cryptocurrencies their hardness.

They argue that the immense energy and other resource requirements needed to mine provide the PoW cryptocurrencies with restricted creation of supply over time moving forward.

In reality, the relationship between mining and hardness is indirect.

The only thing providing a cryptocurrency with hardness is the combination of the protocol, implementation (code), and global decentralization of servers (nodes) running the implementation ensuring that supply is created over time moving forward only as defined within the protocol.

Hardness is maintained only by the decentralized servers enforcing the hardness.

This global decentralization of servers is the "connection to the physical world" that creates hardness and provides security from debasement, attacks, and censorship.

So then what is the energy for?

The energy consumed in PoW systems is a mechanism for introducing entropy (ie randomness) for leader selection within the Nakamoto Consensus protocol. It is purely for competition over the reward.

It is essentially a lottery ticket investment, in which the more capital you invest, and more energy you consume, the more likely you are to win the lottery.

The winner of the lottery wins the right to become the next block producer, and is rewarded with the block reward (currently 6.25 BTC).

This energy-intensive lottery for the block reward is a byproduct of the code's enforcement of supply creation.

There are no direct energy requirements in the Bitcoin protocol. No explicit amount of energy that must be consumed in order for new BTC to be minted.

The Nakamoto Consensus protocol requires a leader to be selected and the implementations enforce this requirement.

It is the protocol, implementation, and decentralization of servers running the implementation which enforce the expected schedule for supply creation that give the asset hardness.

Modern “leaderless” consensus protocols like those of Nano, Avalanche, IOTA, Hedera, etc remove the need for leader selection entirely

They accomplish this by changing the perspective of the source of truth for the decentralized ledger from "the lucky node randomly selected (weighted according to their investment) to be the next block producer" to "my node, with weighted input (votes) on the validity of each transaction from all other nodes."

Rather than needing a mechanism like PoW for selecting a random participant to be the next leader for block production, each participant counts votes for the validity of each transaction from all other participants, and keeps track of the resulting ledger themselves.

So what makes Nano the hardest and likely most scarce known commodity in existence?

It has a fixed supply.

Nano is the first and only original resource in existence known to have a fixed supply.

I qualify it with original because there have been Nano clones that duplicate its fixed supply property.

PLEASE inform me if you know of any other fixed supply commodities that aren't clones of Nano!

One important thing to point out is that fixed supply and capped supply are different concepts. Several cryptocurrencies, Bitcoin included, have a capped supply, but those caps won’t be reached until sometime in the future (nearly 120 years for Bitcoin).

One significant problem with this approach is that it creates a diminishing security model and ecosystem at large. No one can say with certainty what will happen to Bitcoin’s security as the reward subsidies provided to node operators diminishes over time, and they become fully dependent on rising network fees.

Nano’s fixed supply and minimal operational cost for node operators ensures an eternally fixed security model.

I should also clarify that, while IOTA claims to have a fixed supply, in reality, it issues sidechain tokens (ASMB & SMR) for staking IOTA, which effectively cause supply inflation on all tokens within the IOTA ecosystem. For this reason, I do not consider IOTA to be a fixed supply ecosystem.

Do clones of Nano devalue Nano?

No more than clones or forks of PoW cryptocurrencies devalue the original.

Value is derived from demand, which is in turn derived from active development, utilitarian adoption, and community support. None of which is provided by cloning or forking a project.

Cloning or forking a project doesn't replicate its value or take value away from the original, unless it also acquires a significant portion of the active development, adoption, and community support from the original in the process.

How can Nano have a fixed supply if even Bitcoin won't have a fixed supply for nearly another 120 years!

This is possible due to Nano's absolute omission of any inflationary monetary rewards for mining, staking, or any other supply-increasing mechanism.

Instead, Nano relies on natural incentives as the motivator for representatives (Nano node operators).

This means that there is ZERO supply creation over time moving forward.

Money can’t get any harder than zero supply inflation.

Are natural incentives truly enough to motivate nodes to join the network?

The cost to operate a Nano node is comparable to a non-mining Bitcoin node. That is to say: relatively low-cost.

This is important because it means that even the most minor of natural incentives can be enough to motivate representatives to join the network.

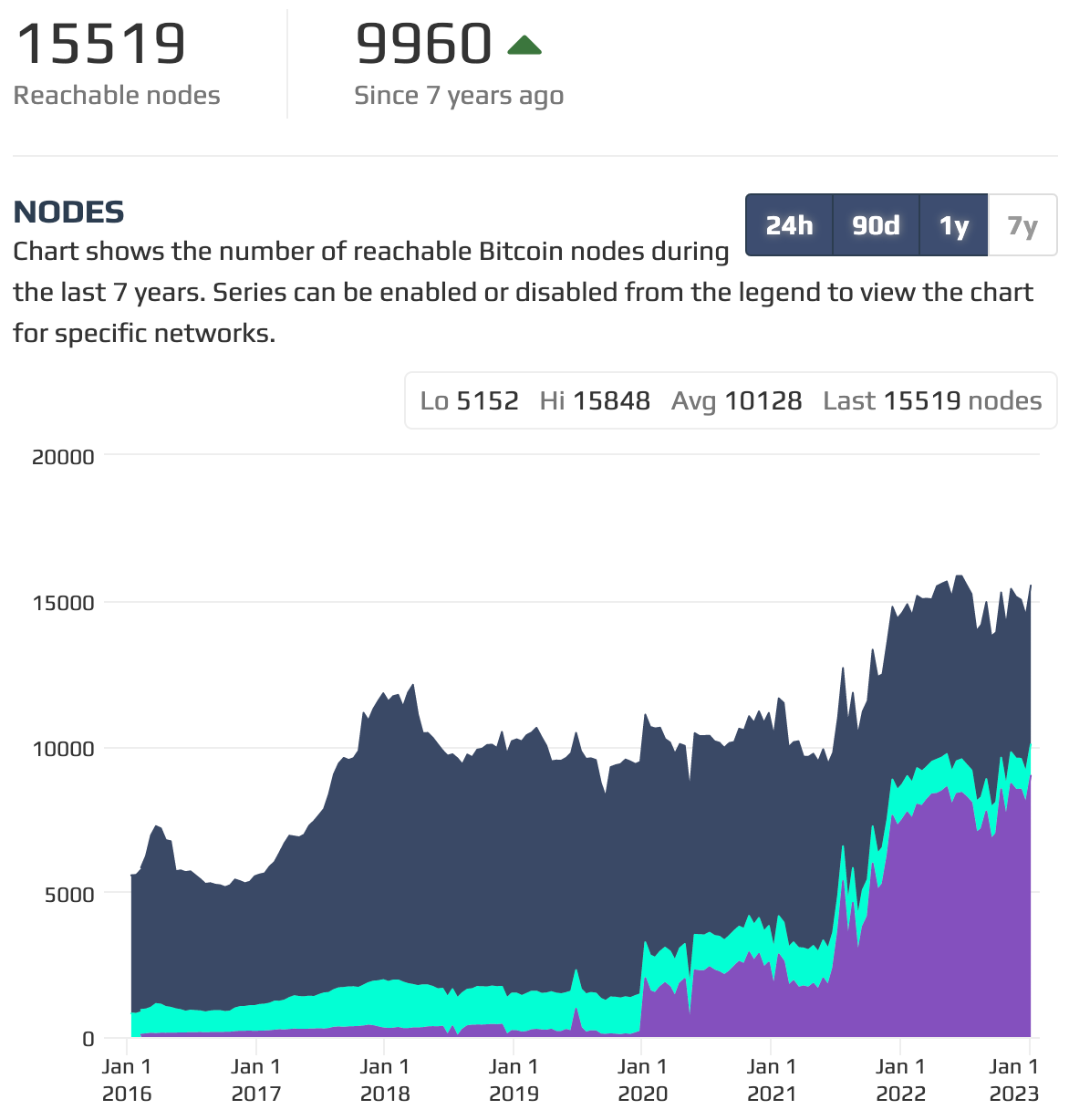

The existence of tens of thousands of non-mining Bitcoin nodes receiving no monetary rewards serves as indisputable empirical evidence that natural incentives are sufficient.

Here's a great article on the topic by

.This also means that Nano naturally and proactively encourages decentralization.

Both Nano users and Nano representatives are naturally incentivized to delegate power over consensus as equally as possible.

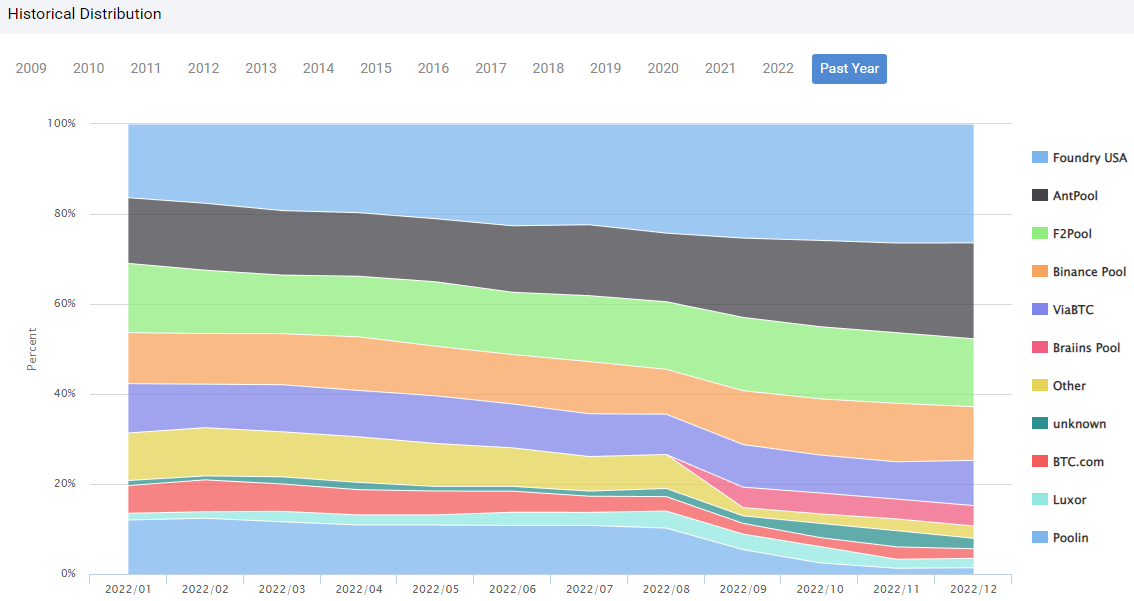

Conversely, in traditional PoW and PoS systems, miners or stakers are incentivized to delegate power over consensus to the largest and most profitable pools.

This, combined with the fact that economies of scale provide greater profitability for the largest mining operations, creates a naturally centralizing force in traditional PoW and PoS cryptocurrencies.

Source: BTC.com

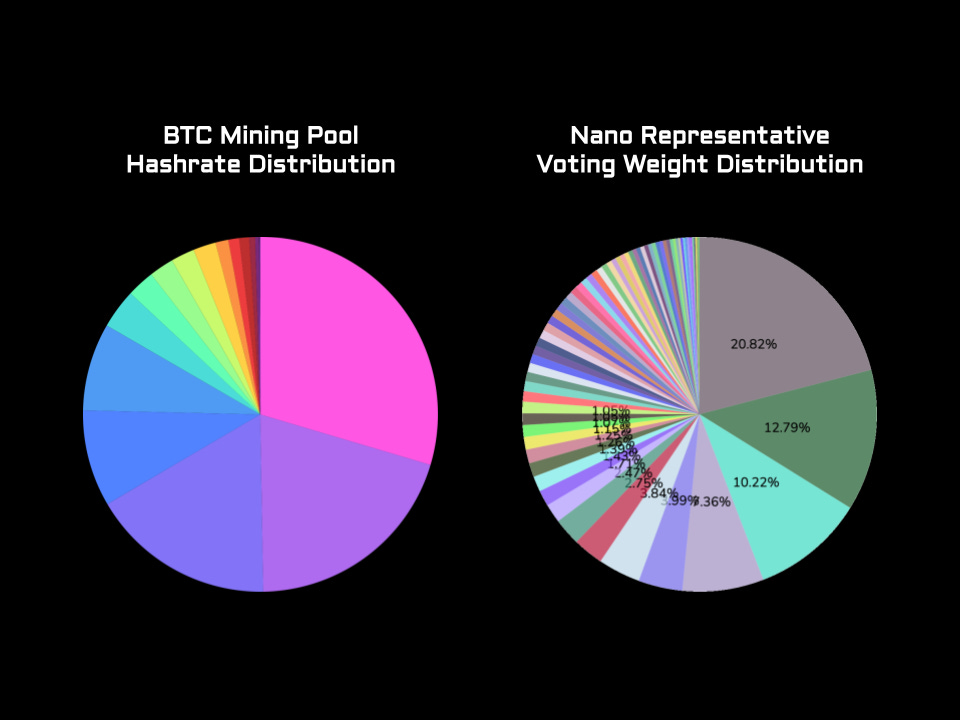

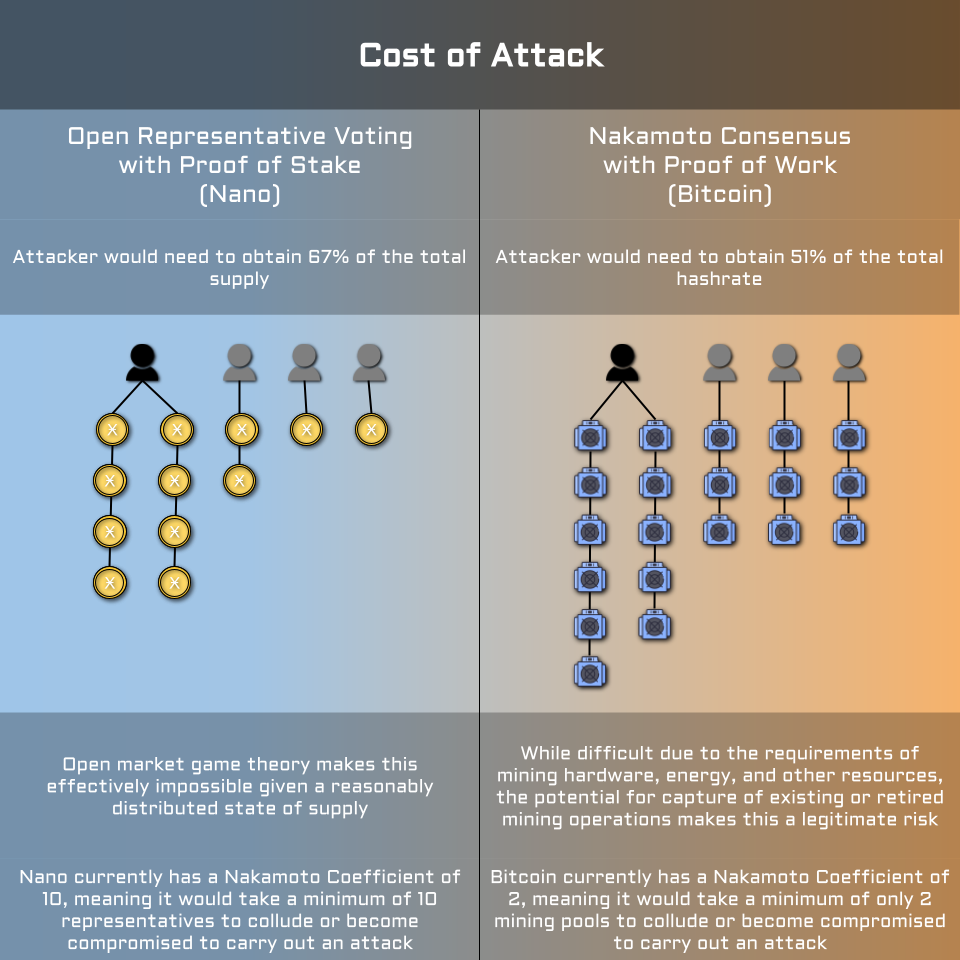

While decentralization can be measured in many different ways, the most considered is an objective measurement for level of decentralization of the power over consensus among the nodes in the network.

This objective measurement is the Nakamoto Coefficient, named after the pseudonymous creator of Bitcoin, Satoshi Nakamoto.

“We define the Nakamoto Coefficient as the minimum number of entities in a given subsystem required to get to 51% of the total capacity” - Balaji S. Srinivasan

In the case of Nano, consensus actually requires a quorum majority of 67%, rather than 51%.

For example, Bitcoin currently has a Nakamoto Coefficient of 2. TWO mining pools currently share more than 50% of the total hashrate.

This means that it would take collusion or compromising of TWO entities to carry out an attack.

In comparison, Nano currently has a Nakamoto Coefficient of 10, meaning it would take a minimum of 10 Nano representatives colluding or being compromised to carry out an attack.

Sources: Blockchain.com and Nanocharts.info

But miners can easily just switch pools if an attack occurs, right!?

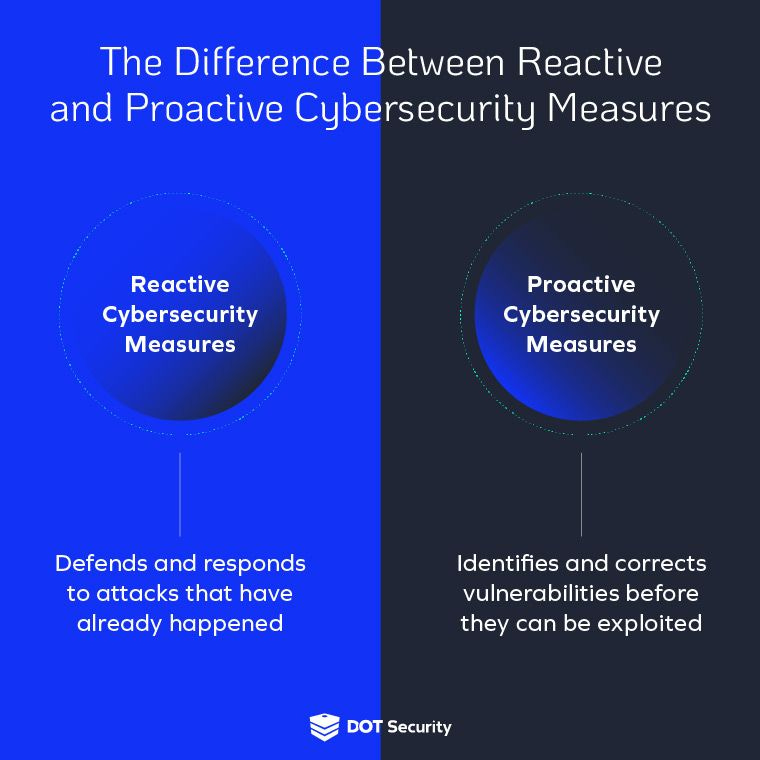

This would be reactive decentralization and security. Action taken after an attack has occurred will not be able to counter the damage to the ecosystem, market, and trust in the system incurred in the attack.

But the longest chain and therefore energy requirement is what makes it hard to carry out a 51% attack or censorship

Not directly.

The energy (and hardware) needed to carry out an attack are nothing more than resources with a value cost.

What matters is the total value cost needed to carry out an attack, and the potential profitability of such an attack.

When assessing profitability of an attack, you must consider both the possibility of profit made by double-spending, and the possibility of profit made by causing the asset's price to decline with a short position.

For PoW systems, the value cost is the $ value of the hardware and energy needed to obtain >51% of the network's total hashrate.

For proof of stake (PoS) systems, that value cost is the $ value of the cost to obtain >51% of the asset's total market capitalization.

Bear in mind that this is not equivalent to the market value of 51% of the supply.

While on the surface, it may seem logical that the cost of PoW resources needed to carry out an attack would outweigh the cost of obtaining >51% of the asset's total market cap, the cost of an attack in PoS would likely be far greater.

This is due to the game theory present in an open market trading scenario.

This is all covered in extensive detail in this excellent article by Viktor Bunin.

"In practice, no one will go out and start buying up tokens to attack PoS networks. It doesn’t make any sense. Putting aside that it is incredibly expensive, even for “small” networks, it is also just operationally difficult to find that many willing token holders that are willing to part with their stakes as you start driving the market price up." - Viktor Bunin

In conclusion, Nano's strong conviction in maintaining a fixed supply through the elimination of inflationary monetary rewards for node operators provides its strengths in hardness and decentralization.

Nano is the hardest and only known fixed supply commodity in existence, and that's just one small part of what makes it great money.

I'm unsure of the mechanism by which a bitcoin mining pools can manipulate transactions.